Go green and save big with Prime Loan Company’s Solar Loan Options.

A Solar Loan is a smart financial solution designed to help individuals and businesses adopt solar energy systems without the burden of high upfront costs. With Prime Loan Company, you can install rooftop solar panels and all necessary components while repaying the amount in affordable monthly installments.

This not only helps you reduce electricity expenses but also supports your transition to clean and sustainable energy.

What is a Solar Loan?

A Solar Loan from Prime Loan Company is a structured financing plan that empowers MSMEs, homeowners, and enterprises to switch to solar power for residential, commercial, or industrial use. Instead of paying the full cost upfront, you can choose a flexible repayment plan with low EMIs and attractive interest rates.

With Prime Loan’s Rooftop Solar Finance, you gain the dual benefit of long-term savings on energy bills and a positive step toward a greener tomorrow. Embrace renewable energy with ease—choose Prime Loan Company.

Features and Benefits of Solar Loan

Flexible Tenure: 12 to 84 months

No Additional Collateral Required

Minimum Turnover 25 Crores

Minimum 5 Years Old Company

Loan Amount: Minimum 60 Lakhs to Rs 3 Crores

Dedicated & Personalized Support

Minimal Documentation & Digital Processing

Loan EMIs Lower Than Your Current Electricity Bills

Comprehensive Financing: Covers solar panels + ancillaries

Quick Approvals: Score-based assessment for faster processing

Competitive Interest Rates: 7.99% Flat Rate or 12.5% Reducing Balance Rate onwards

Eligibility Criteria Required for Solar Loans

AABB Program

- Maximum Loan Limit = LTV or eligible loan amount based on maximum allowed EMI, whichever is lower.

- Maximum EMI = 0.50 x ABB (ABB = Average bank balance in operative account of the customer for last 12 months)

GST Program

- Latest 12 months’ GST turnover

- Apply industrynet margin on the turnover

- Calculate DSCR considering existing and proposed obligations

- Eligible EMI at DSCR 1.2 to be considered

Saving with Renewable Energy

- Collect latest 3 months of electricity bills

- Calculate average energy consumption in units and amount.

- Calculate energy savings with solar panel installation for the same consumption.

- Add back the savings for a higher loan eligibility.

Documents Required for Solar Loans

For a seamless Rooftop Solar Panel loan approval process, the following documents are required:

For Company KYC

- GST Certificate

- Shop Light Bill

- Udyam Registration Certificate

Applicant & Co-Applicant KYC

- PAN Card

- Aadhaar Card

- Residence Electricity Bill

Financial Documents.

- Bank Statement (Last 1 year – PDF format)

- Last 2 Years ITR

Solar Loan EMI Calculator

Use our Solar Loan EMI Calculator to estimate your monthly installments. Simply enter your loan amount, interest rate, and tenure to get an instant EMI calculation. This helps you plan your solar investment efficiently and choose a loan option that best suits your financial needs.

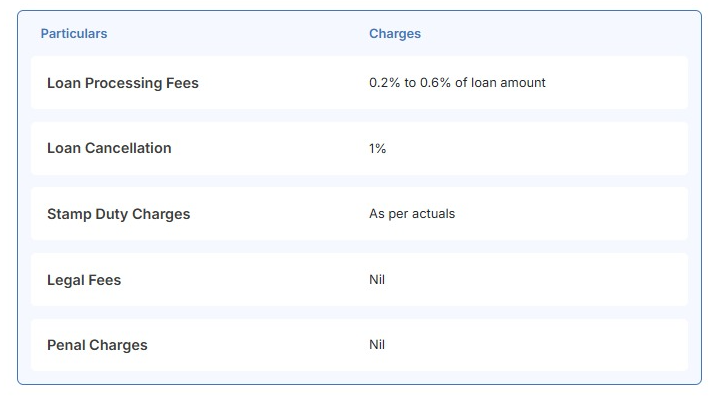

Fees and Charges for Solar Loan

The fees and charges of solar loans usually vary from lender to lender and from case to case. The aforementioned table will give you a fair idea of the fees and charges related to solar loans:

Other fees and charges that lenders may levy on your solar loan include documentation charges, verification charges, duplicate statement charges, NOC certificate charges and swap.

Solar Loan FAQs

Can I install solar on EMI?

Yes, you can install solar panels on EMI with our Rooftop Solar Finance, which offers flexible loan repayment options tailored to your financial needs.

What is the cost of solar panels for rooftops?

The cost of solar panels for rooftops varies based on capacity, brand, and installation requirements. Typically depends on the lenders, on the size and efficiency of the system.