Get quick and secure Gold Loans with no hidden charges, transparent terms, and fast approvals.

Gold Loan Features

Loan in just 15 minutes

Apply with PAN or Aadhaar Card

Loans starting from Rs.5,000

Multiple repayment options

Features and Benefits of our Education Loan

- Secured Loan: Backed by gold collateral.

- Quick Processing: Fast approval and disbursement.

- Flexible Loan Amount : Based on pledged gold value.

- Instant Liquidity: Access funds quickly without selling gold.

- Lower Interest Rates: Secured nature leads to competitive rates.

- Versatile Use: No restrictions on how loan funds are used.

Gold Loan Eligibility and Documents

Read on to know the criteria required to apply for our Gold Loan.

Eligibility Criteria

- Age: Typically, borrowers should be 18 years or older.

- Ownership: You must own the gold being pledged.

- Gold Quality: The gold should meet the lender’s purity standards.

- Identification: Valid government-issued ID for identity verification.

Documents Required to Apply for Gold Loan

- Identity and signature proof

- Voter ID

- Passport

- Aadhaar Card

- Driving License

- PAN Card

- Employee Identity Card (in case of government employees)

- Address Proof

- Rent Agreement

- Bank Statement

- Voter ID Card

- Passport

- Driving License

- Telephone/Electricity/Water/Credit Card bill or Property tax.

- Two post-dated cheques for security purposes

- Passport-size photographs

How to Apply for Gold Loan at PrimeLoan?

To apply for a gold loan, you can follow these general steps. Keep in mind that the specific process might vary depending on the lender and the country you’re in. Here are few points to keep in mind before Applying Gold Loan:

- Choose a Lender: Research and choose a reputable lender that offers gold loans. This could be a bank, a financial institution, or a specialized gold loan company.

- Check Eligibility: Review the eligibility criteria set by the lender. Typically, you’ll need to be of a certain age and own gold jewelry that meets the lender’s criteria.

- Visit the Branch or Website: You can either visit the nearest branch of the lender or apply online through their official website or mobile app, if available.

- Gold Evaluation: If applying in person, bring the gold you want to pledge as collateral to the lender’s branch. They will evaluate the gold’s purity, weight, and value to determine the loan amount you’re eligible for. If applying online, you might need to visit the branch for this step. These days few fintech comapnies offer this service at customer’s doorstep as well.

Gold Loan EMI Calculator

How is Gold Loan EMI Calculated?

Gold Loan EMI (Equated Monthly Installment) is calculated using the following Compound Interest formula:

EMI = [P * r * (1 + r)^n] / [(1 + r)^n – 1]

Where:

EMI = Equated Monthly Installment

P = Gold Loan principal amount

r = Monthly interest rate (Annual interest rate divided by 12, expressed as a decimal)

n = Gold Loan tenure in months

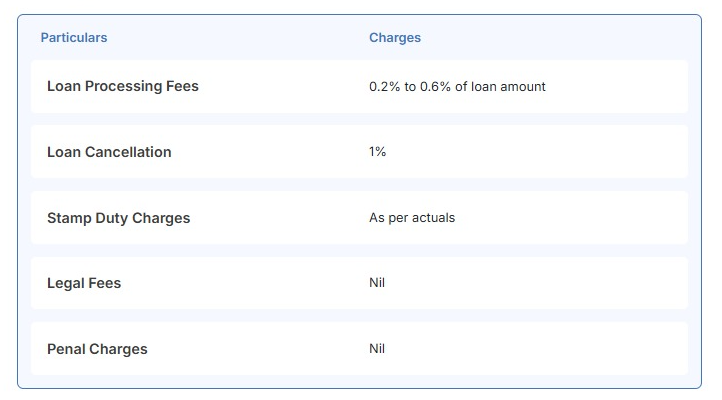

Fees and Charges for Gold Loan

The fees and charges of gold loans usually vary from lender to lender and from case to case. The aforementioned table will give you a fair idea of the fees and charges related to gold loans:

Other fees and charges that lenders may levy on your personal loan include documentation charges, verification charges, duplicate statement charges, NOC certificate charges and swap.

Gold Loan Reviews

I visited the Prime Loan Company branch in Andheri East, and the staff there were extremely friendly and helpful. My Gold Loan was sanctioned within just a couple of hours, and the interest rates were very reasonable—aligned with government norms. The entire process was smooth and timely. I had a really good experience and truly appreciate their excellent service.

Seema Singh

Happy Client

Prime Loan Company helped me get an instant gold loan with complete ease. With all my KYC documents ready, I visited HDFC Bank to deposit my gold and received the loan disbursal instantly. I was offered a very competitive interest rate of just 3%. One important tip—make sure your gold is more than 18 carats to qualify. Great service by Prime Loan and a smooth overall experience!

Rajni Malhotra

Happy Client

Through Prime Loan Company, I availed a gold loan from HDFC at an attractive 4% interest rate. I received an acknowledgement card with all the payment details, and I regularly get SMS alerts for renewals. I have the flexibility to either make a full payment once a year or simply pay the interest amount and renew the loan. The entire process was smooth and transparent—great service by Prime Loan!

Raj

Happy Client

Prime Loan Company helped me get an instant gold loan with complete ease. With all my KYC documents in place, I visited HDFC Bank, deposited my gold, and received the loan disbursal instantly. I was offered a competitive interest rate of just 3%. One important thing to note—your gold should be more than 18 carats to qualify. Great service and smooth experience by Prime Loan Company!

Padma

Happy Client

FAQs

What is a gold loan?

A gold loan is a type of secured loan where gold jewelry or ornaments are used as collateral. The value of the loan is determined based on the market value of the gold provided as security. Gold loans are typically short-term loans with a quick disbursal process and are commonly used for meeting urgent financial needs.

What is the maximum loan amount I can get?

The maximum loan amount you can get for a gold loan depends on several factors, including the purity and weight of the gold provided as collateral, the lender’s policies, and the prevailing market value of gold. Typically, lenders offer loans ranging from 60% to 80% of the value of the gold ornaments pledged as collateral. However, the actual loan amount offered to you will depend on the specific terms and conditions of the lender.

What's the repayment period for a gold loan?

The repayment period for a gold loan is typically short-term, ranging from a few months to a few years, depending on the lender and the loan amount. Some lenders offer flexible repayment options, allowing borrowers to repay the loan in EMIs or as a lump sum at the end of the loan term. It’s important to check with the lender for the specific repayment terms and options available for the gold loan.

What happens if I can't repay the loan?

If you can’t repay a gold loan, the lender may auction off the gold ornaments pledged as collateral to recover the outstanding loan amount. It’s important to communicate with the lender and explore repayment options to avoid losing your gold.

Is the gold safe with the lender?

After repaying your gold loan, you can retrieve your gold by submitting a request to the lender. The lender will verify that the loan has been fully repaid and then return your gold jewelry or ornaments to you.

What is the process for gold retrieval after loan repayment?

Yes, the gold pledged as collateral for a gold loan is generally safe with the lender. Lenders are required to follow strict guidelines for the safekeeping of the gold, including secure storage facilities and insurance coverage. Additionally, borrowers receive a receipt for the gold pledged, detailing the quantity and quality of the gold. It’s important to choose a reputable lender to ensure the safety of your gold.

Is there a difference between a Gold Loan and a Personal Loan?

Yes, there are differences between a gold loan and a personal loan. A gold loan is a secured loan where you pledge gold as collateral, while a personal loan is an unsecured loan that does not require collateral. Interest rates for gold loans are typically lower than personal loans due to the collateral involved. Additionally, the loan amount for a gold loan is determined by the value of the gold pledged, whereas a personal loan amount is based on your creditworthiness. The repayment periods may also differ, with gold loans often having shorter terms than personal loans.