Enjoy fast approvals, minimal documentation, and flexible EMIs designed to suit your budget.

Car Refinance Features

Loan of up to ₹ 47 Lakh

3 Unique Variants

Tenure of up to 72 months

Minimal Documentation

Features and Benefits of our Car Refinance

Lower Payments : Get a new loan with a lower interest rate, reducing your monthly payments.

Max Funding : Get Up to 250% Market Valuation Funding

Shorten Loan Term : Opt for a shorter loan duration to pay off your car sooner.

Different Lende : Switch to a new lender for potentially better terms.

Adjustable Terms: Tailor the loan terms to better match your current financial situation.

Pay Off Sooner : Shorter loan terms help you become debt-free faster.

Improved Financial Situation : Adjusting terms can align your loan with your current circumstances.

Car Refinance Eligibility and Documents

Read on to know the criteria required to apply for our Car Refinance.

Car Refinance Eligibility

Car Refinance Eligibility Calculator- Link to EMI Calculator

Car Refinance Eligibility Criteria for Top Banks :

- Age: Generally 21-65 years.

- Income: Minimum monthly or yearly earnings.

- Employment: Stable job with experience (1-2 years).

- Credit Score: Good score, often 680 or higher.

- Documentation: ID, address, income proofs, car papers.

- Loan Amount: Based on income and repayment ability.

- Debt-to-Income Ratio: Consideration of existing debts.

- Paid EMIs: Car owners who have paid at least 12 EMIs on an active car loan.

For Salaried Individuals

- Individuals who are at least 21 years old at the time of loan application and no older than 60 at the end of the loan tenure

- Individuals who have worked for at least two years, with at least one year with the current employer

- Individuals with a minimum earning of Rs. 2,50,000 per year, including the income of the spouse/co-applicant.

- Individuals who own a car have paid at least 12 EMIs if there is an active loan.

For Self-Employed Individuals

- Individuals who are at least 25 years old at the time of application and no older than 60 at the end of the loan tenure.

- Those who have been in business for at least two years.

- Should earn at least Rs. 2,50,000 per year

- Individuals who own a car have paid at least 12 EMIs if there is an active loan.

Factors Affecting Car Refinance Eligibility :

- Credit Score

- Income Level

- Employment Stability

- Debt-to-Income Ratio

- Age of Car

- Loan Amount Requested

- Down Payment Amount

- Loan Tenure

- Credit History

- Existing Financial Obligations

Documentation for Car Refinance

You will be asked to submit papers suggested by your lender to show your eligibility and competence for a New Car Loan To begin the Loan procedure, keep the following documents on hand to obtain a Loan as soon as possible.

List of Documents Required

- KYC documents (Valid Photo ID Proofs)

- PAN Card

- Last 2 years’ ITR as proof of income (for self-employed individuals)

- Salary Slip (latest 3 months)

- Salary account statement (latest 6 months)

- Signature Verification Proof

- Registration Certificate of the Car

- Loan track (if there is an active loan on the car)

- Car Insurance

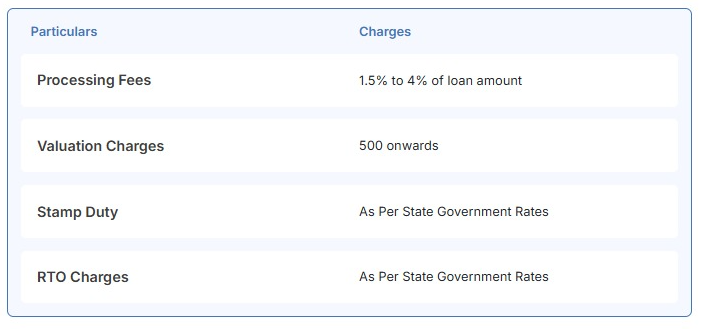

Fees and Charges

Car Refinance Reviews

I was in urgent need of an instant business loan, but most options in the market were too expensive. That’s when I connected with Prime Loan Company and discovered that I could mortgage my car just like any other asset—as long as there was no ongoing loan on it. They helped me apply for a Car Refinance loan and I received 100% of my car’s current value as the loan amount. The entire process was smooth, and the loan was disbursed within just four days at one of the lowest interest rates in the market. Truly impressed with Prime Loan’s smart and efficient loan solutions!

Seema Singh

Happy Client

Cars are often considered a liability, but the right guidance can turn that liability into a valuable asset. That’s exactly what happened when I connected with Praveen from Prime Loan Company. He introduced me to the concept of Car Refinance and helped me secure a loan against my existing car. Thanks to his expert advice and support, I was able to unlock funds quickly and easily. Prime Loan truly offers smart financial solutions when you need them most!

Rajni Malhotra

Happy Client

FAQs on Car Refinancing

What's car refinancing?

Car refinancing means getting a new loan to replace your existing car loan.

Why would I refinance my car?

To get better loan terms, like lower interest rates or monthly payments.

Can I refinance any type of car?

Generally, yes, but some lenders might have restrictions.

How do I know if I should refinance?

If your financial situation has improved or if you find better loan options.

What's equity and why does it matter?

Equity is the difference between your car’s value and what you owe. Positive equity is important for refinancing.

Does refinancing affect my credit score?

Applying for refinancing might have a slight impact on your credit score.

How do I start the refinancing process?

You apply with a new lender, and if approved, they pay off your old loan and you start with them.