We are India’s Leading Auto Loan DSA Agent

Earning Opportunity for all existing agents with Prime Loan Loan Partner Program

Who can Become a Auto Loan DSA with Prime Loan?

Enhance your professional status. Fire up your entrepreneurial instincts and drive into victory! Any person with interpersonal skills and a passion for success can be a part of Team Prime Loan.

Loan Agent

Ex-Banker

Financial Analyst

Mutual Fund Agent

Chartered Accountant

Builder

About Loan Agent Partner

You’re a Loan Agent who is knowledgeable about all types of loans offered by the financial institutions you represent and can advise people on the best options. Get your Prime Loan Loan Agent Partner Advantage now and advise people on how to finance their dreams!

Help Finance Your Clients' Futures Now

- Personal Loans

- Home Loans

- Business Loans

- Auto Loans and More

What Are The Eligibility Criteria For The Prime Loan Auto Loan DSA Registration Process?

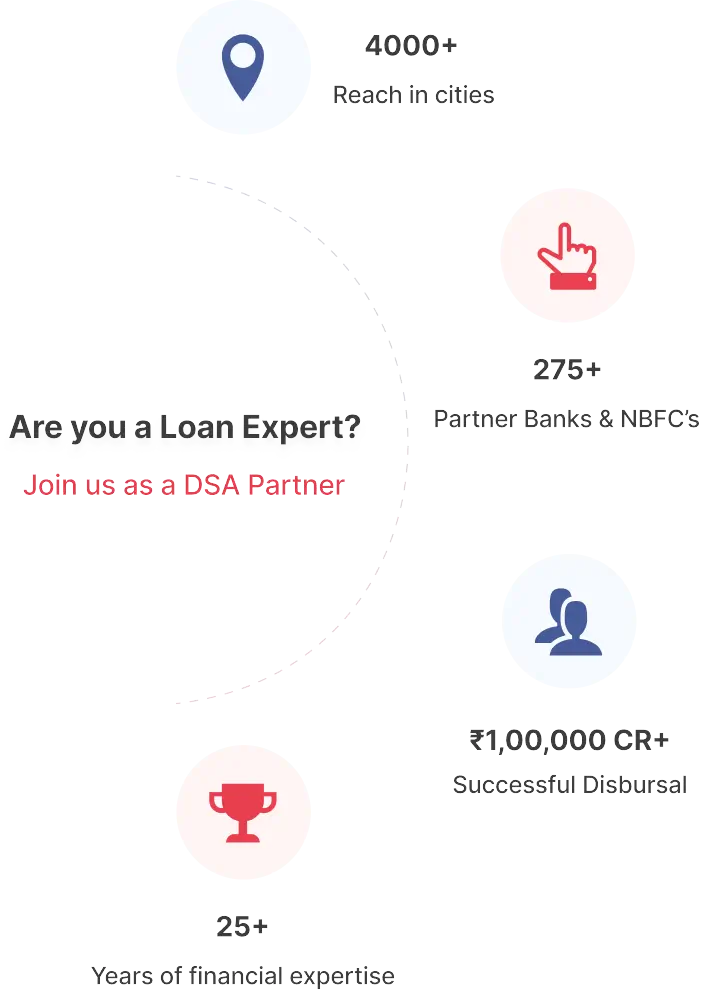

Prime Loan, a registered DSA, has partnerships with more than 275 leading Banks and NBFCs to offer loans in more than 4000 cities in India. Prime Loan retail portfolio includes Personal Loans, Business Loans, Home Loans, Loan against Property or Mortgage Loans, New Car Loan , Used Car Loan & Car Refinance, Credit Cards, and more. Eligibility criteria to operate as a Loan DSA Partner or Loan DSA Franchise are as follows:

To Become a DSA Loan Agent Registration, you need to meet the following eligibility criteria:

Age

You must be over 25 years of age.

Nationality

You must be a Resident Citizen of India

Educational Qualifications

There are no educational requirements to qualify as a Prime Loan Loan DSA Partner

Professional Qualifications

Whether you are a working professional, or a business owner, you are welcome to register as a Prime Loan Loan DSA Franchise

Process Of Auto Loan DSA Registration

Registering to partner with Prime Loan makes for a good start to a successful DSA career. This guide will walk you through each Online Loan DSA Registration step as you begin and grow your business.

Here is the step-by-step guide for Loan DSA Partner Registration

Step -

1

Apply

Click on "Apply Now", fill in the Loan DSA Partner registration details, and submit along with the documents.

Step -

2

Expect a Call

The Prime Loan support team will call you to guide and coordinate a meeting with you.

Step -

3

Meet

At the meeting, a Prime Loan Manager will explain all you need to know, including the process to follow while generating leads.

Step -

4

Sign DSA Agreement

After signing the DSA agreement, you will become a Prime Loan Partner and can start earning instantly.

Once you’re comfortable with the processes and procedures, an agreement will be inked between you and Prime Loan. Once signed and stamped, you will be an official Prime Loan Loan DSA Partner running a Loan DSA Franchise.

Why Partner With Prime Loan? - Benefits And Perks

Prime Loan, a one-stop-shop for all types of Loans, Credit Cards, Fixed Deposits, and Insurance covers 4000+ cities in India to serve 500 million under-served borrowers. Prime Loan’ 25+ years’ financial products distribution legacy, 275+ partner banks and NBFCs, and yearly business of Rs 30,000+ crores bear testimony to a successful journey in the world of finance. Other than the above, the following are the reasons why you should go for Online Loan DSA Registration to partner with Prime Loan as a Loan DSA Partner:

Investment Free

Instant Pay-outs

High Potential Industry

Guaranteed Success

Channel Partner Recognition

Easy Process

We partner with industry front-runners to jointly deploy and lead upwardly mobile financial aspirations!

Features And Earnings of Auto Loan DSA Program

In your role as a Prime Loan Business Partner in our Loan DSA Partner program as a Loan DSA Franchise, you do the following:

Identify Clients

Check and Verify Leads

Help Pick Finance Provider

Expect Early Loan Disbursals

Trained to be a professional Prime Loan Agent by first-class focused coaches and specialists supported by effective and superior digital backend technology and experts, you benefit from our DSA program through Online Loan DSA Registration as follows:

Personal Loan DSA FAQs

Prime Loan offers a lucrative opportunity to partner as an Auto Loan DSA, providing access to a wide range of financial products and services tailored to meet the diverse needs of clients.

Partnering as an Auto Loan DSA with Prime Loan opens doors to a vast network of lenders, competitive loan products, and comprehensive support to help you succeed in the dynamic financial services industry.

Applying to become an Auto Loan DSA with Prime Loan is a seamless process. Simply visit our website, navigate to the designated section, and follow the step-by-step instructions to submit your application online.

Individuals with a passion for finance, strong networking skills, and a drive to excel in the lending industry can become successful Auto Loan DSA partners with Prime Loan.

As an Auto Loan Agent, your responsibilities include sourcing potential clients, understanding their financial needs, guiding them through the loan application process, and ensuring timely follow-ups for successful loan closures.

Prime Loan provides extensive training, marketing materials, dedicated relationship managers, and ongoing assistance to empower you as an Auto Loan Agent and help you achieve your business goals.

Once your application is approved and you complete the necessary training, you can start working as a DSA for Auto Loans with Prime Loan. The timeline may vary based on individual readiness and compliance fulfillment.

Utilize Prime Loan' advanced CRM tools, maintain detailed records of client interactions, set reminders for follow-ups, track lead progress in real-time, and leverage data analytics to optimize your lead management strategies for enhanced productivity.

An Auto Loan Agent acts as an intermediary between borrowers and lenders, facilitating loan applications, providing financial guidance, evaluating creditworthiness, and ensuring smooth loan processing for clients seeking Auto Loans.

Individuals with strong communication skills, knowledge of financial products, sales acumen, and a customer-centric approach can excel as an Auto Loan Agent in the competitive lending landscape.

To apply for an Auto Loan DSA position with Prime Loan , visit our website, fill out the online application form accurately, submit the required documents, undergo training sessions, and kickstart your journey towards becoming a successful loan agent.

By partnering with Prime Loan as a Business Loan Agent, you gain access to competitive commissions, diverse product offerings from leading financial institutions, continuous training opportunities, marketing support, and personalized guidance to enhance your career growth in the financial services sector.

Join us today for a rewarding career in the financial services industry!

FAQs

Who can become a partner with Prime Loan?

Anyone with an interest in financial services and a drive to grow can become a Prime Loan DSA Partner. Whether you’re a loan agent, ex-banker, financial analyst, mutual fund agent, chartered accountant, builder, or a professional from any other field, you are welcome to join us. If you’re looking to offer a wide range of financial products while earning attractive commissions, Prime Loan is the perfect platform for you.

What documents are required for DSA registration?

At Prime Loan, our DSA registration process is designed to be straightforward and hassle-free. The required documents for KYC verification include:

- Aadhaar Card

- PAN Card

- Two passport-size photographs

- GST Registration (for companies, if applicable)

- Proof of Employment: 3 months’ Salary slips if employed; account statements and address proof if running a business; or invoices and financial statements if self-employed.

- Bank Account Details: Your bank statement for the last 6 months.

These documents help us ensure a seamless registration process, getting you started on your journey as a Loan DSA Agent in no time.

What are the eligibility criteria to become a Prime Loan DSA Partner?

To become a Prime Loan DSA Partner, you need to meet the following Eligibility Criteria:

- Age Requirement: You must be at least 25 years old.

- Nationality: You must be a Resident Citizen of India.

- Educational Qualifications: No specific educational qualification is required.

- Professional Qualifications: Whether you are a working professional or a business owner, you can register as a Prime Loan DSA Agent. Ideal candidates include loan agents, ex-bankers, financial analysts, mutual fund agents, chartered accountants, and builders.

Prime Loan welcomes individuals from diverse professional backgrounds who are looking to expand their income opportunities.

How do I register as a Loan DSA Agent with Prime Loan?

To become a Loan DSA Agent with Prime Loan, follow these simple steps:

- Step 1: Visit the Prime Loan website and click on the ‘Become a Partner’ option.

- Step 2: Complete the registration form by filling in your details and submitting it.

- Step 3: A member of the Prime Loan support team will contact you to guide you through the next steps and arrange a meeting.

- Step 4: During the meeting, a Prime Loan Manager will explain the lead generation process and provide you with all the necessary information.

- Step 5: Once you understand and are comfortable with the processes, an agreement will be signed between you and Prime Loan.

After the agreement is signed and stamped, you will officially become a Prime Loan DSA Agent.

Connect with us today to start your journey as a Loan DSA Agent and unlock the potential to earn attractive commissions while helping customers secure the best financial products!

What are the benefits of becoming a Loan DSA Partner with Prime Loan?

Becoming a Loan DSA Partner with Prime Loan comes with multiple benefits. You start earning attractive commissions right from your first client. Prime Loan provides on-time payouts, and the more leads you convert, the higher your earnings. As a Loan DSA Agent, you gain access to a wide range of loan products from 300+ top banks and NBFCs, along with dedicated support, training, and a powerful platform to grow your financial distribution business seamlessly.

What kind of financial products can a Prime Loan DSA offer?

“Prime Loan DSAs provides an extensive range of financial products, such as personal loans, home loans, business loans, “, loans against property, “, “, car loans, “, “, education loans, ” credit cards, auto loans, gold loans, Mutual Funds, Insurance, and credit cards, under one roof.”

What support do Prime Loan provide to its DSAs?

Prime Loan is committed to the success of its DSAs by offering extensive support in the following areas:

- Comprehensive Training: We provide detailed training sessions to help you understand our products, processes, and the market.

- Marketing Support: You can get leads, marketing materials, and strategies from Prime Loan to promote your services effectively.

- Timely Payouts: We ensure that you receive your commissions on time, providing a smooth and transparent payout process.

By partnering with Prime Loan, you get all the support you need to grow and succeed as a DSA.

Can I work as a Prime Loan DSA alongside my current job or business?

Yes, you can! Prime Loan welcomes individuals from all professional backgrounds to become a DSA (Direct Selling Agent) alongside their current job or business. Whether you’re a CA, doctor, real estate broker, working professional, or self-employed, if you have good communication skills and a basic understanding of finance or banking, you can register as a DSA with Prime Loan. This allows you to earn additional income by helping others secure loans and financial products while continuing with your existing career or business.

We Are Available In Cities

- Mumbai

- Delhi