Get access to the best Used Car Loan deals with lower interest rates in the market.

Used Car Loan Features

Loan of up to ₹ 47 Lakh

3 Unique Variants

Tenure of up to 72 months

Minimal Documentation

Features and Benefits of our Used Car Loan

- Seize Opportunity : Own a quality used car without waiting to save up the full amount (up to 100% of Market valuation)

- Budget-Friendly : We lend you the funds required to purchase the used car, repaid in manageable monthly installments or OD Facilities.

- Flexible Options : Choose from various used car models that suit your preferences.

- Immediate Ownership : Drive your desired used car without the delay of saving for years.

- Great Value : Get a reliable used car with excellent value and features.

- Build Credit : Consistent payments can help enhance your credit histor

Used Car Loan Eligibility and Documents

Read on to know the criteria required to apply for our Used Car Loan.

Used Car Loan Eligibility

Used Car Loan Eligibility Calculator- Link to EMI Calculator

Used Car Loan Eligibility Criteria for Top Banks :

- Age: Generally 21-65 years.

- Income: Minimum monthly or yearly earnings.

- Employment: Stable job with experience (1-2 years).

- Credit Score: Good score, often 680 or higher.

- Down Payment: A certain percentage of the car’s cost.

- Documentation: ID, address, income proofs, car papers.

- Loan Amount: Based on income and repayment ability.

- Debt-to-Income Ratio: Consideration of existing debts.

- Vehicle age: Within 15 years at the end of tenure.

For Salaried Individuals

- Individuals who are at least 21 years old at the time of loan application and no older than 60 at the end of the loan tenure.

- Individuals who have worked for at least two years, with at least one year with the current employer.

- Individuals with a minimum earning of Rs. 2,50,000 per year, including the income of the spouse/co-applicant.

For Self-Employed Individuals

- Individuals who are at least 25 years old at the time of application and no older than 65 at the end of the loan tenure.

- Those who have been in business for at least three years.

- Should earn at least Rs. 2,50,000 per year

Factors affecting Used Car Loan Eligibility:

- Credit Score

- Income Level

- Employment Stability

- Debt-to-Income Ratio

- Age of Car

- Loan Amount Requested

- Down Payment Amount

- Loan Tenure

- Credit History

- Existing Financial Obligations

Documentation for Used Car Loans

You will be asked to submit papers suggested by your lender to show your eligibility and competence for a Used Car Loan. To begin the Loan procedure, keep the following documents on hand to obtain a Loan as soon as possible.

List of Documents Required

- KYC documents (Valid Photo ID Proofs)

- PAN Card

- Last 2 years’ ITR as proof of income

- Salary Slip (latest 3 months)

- Salary account statement (latest 6 months)

- Signature Verification Proof

- Registration Certificate of the Car

- Car Insurance

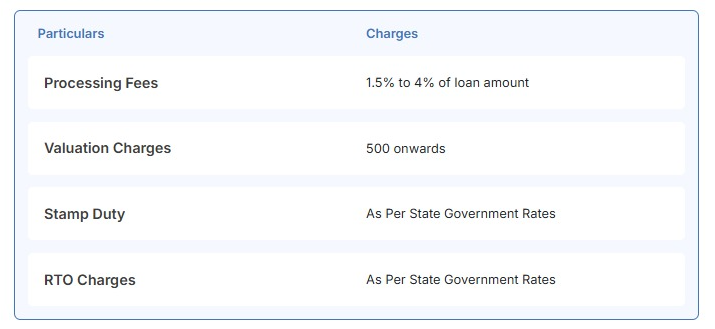

Fees and Charges

Used Car Loan Reviews

I was looking to buy a used car for my daily commute from home to work, but I didn't have enough savings to cover the down payment. Thanks to Ruloans, I was able to secure a car loan for 90% of the car's value for the best interest rate on the market.

Seema Singh

Happy Client

I had previously taken a personal loan through Ruloans, and I was thoroughly impressed with their service. So, when I decided to buy a car, I knew exactly whom to contact for my used car loan application. Ruloans is the expert in the loan industry, and no matter the type of loan, they get the job done efficiently.

Rajni Malhotra

Happy Client

FAQs on Used Car Loans

What's a used car loan?

It’s money you borrow to buy a used car and then repay in installments.

How does a used car loan work?

You get the loan, buy the car, and then pay back the loan with interest over time.

What's the loan term?

It’s how long you have to repay the loan, often a few years.

Can I get a used car loan for any car?

Generally, yes, but lenders might have rules about car age and condition.

What's a down payment?

It’s a part of the car’s cost you pay upfront, and the rest is covered by the loan.

Do I need a good credit score?

A good score helps, but some lenders might work with lower scores too.