Get the best New Car Loan offers with lower interest rates and flexible repayment plans.

New Car Loan Features

Loan of up to ₹ 47 Lakh

3 Unique Variants

Tenure of up to 72 months

Minimal Documentation

Features and Benefits of our New Car Loan

Quick Car Ownership : Get your dream new car without waiting to save up all the money (Avail up to 100% of On Road Cost)

Flexible Financing : We lend you the funds needed to buy the car, and you pay us back in smaller, manageable installments or OD facilities.

Enjoy the Newness : Experience the excitement of a brand-new car with all its latest features.

Options Galore : Choose from a wide range of new car models that suit your taste and needs.

Building Credit : Making regular payments can help improve your credit score over time.

Warranty Coverage : Many new cars come with warranties that provide peace of mind.

New Car Loan Eligibility and Documents

Read on to know the criteria required to apply for our New Car Loan.

New Car Loan Eligibility

New Car Loan Eligibility Calculator- Link to EMI Calculator

New Car Loan Eligibility Criteria for Top Banks :

- Age: Generally 21-65 years..

- Income: Minimum monthly or yearly earnings.

- Employment: Stable job with experience (1-2 years).

- Credit Score: Good score, often 700 or higher.

- Down Payment: A certain percentage of the car’s cost

- Documentation: ID, address, income proofs, car papers.

- Loan Amount: Based on income and repayment ability.

- Debt-to-Income Ratio: Consideration of existing debts.

For Salaried Individuals

- Individuals who are at least 21 years old at the time of loan application and no older than 60 at the end of the loan tenure

- Individuals who have worked for at least two years, with at least one year with the current employer

- Individuals with a minimum earning of Rs. 2,50,000 per year, including the income of the spouse/co-applicant.

For Self Employed Individuals

- Individuals who are at least 25 years old at the time of application and no older than 65 at the end of the loan tenure.

- Those who have been in business for at least three years.

- Should earn at least Rs. 2,50,000 per year

Factors Affecting New Car Loan Eligibility :

- Credit Score

- Income Level

- Employment Stability

- Debt-to-Income Ratio

- Loan Amount Requested

- Down Payment Amount

- Loan Tenure

- Credit History

- Existing Financial Obligations

Documentation for New Car Loans

You will be asked to submit papers suggested by your lender to show your eligibility and competence for a New Car Loan. To begin the Loan procedure, keep the following documents on hand to obtain a Loan as soon as possible.

List of Documents Required

- KYC documents (Valid Photo ID Proofs)

- PAN Card

- Last 2 years’ ITR as proof of income

- Salary Slip (latest 3 months)

- Salary account statement (latest 6 months)

- Signature Verification Proof

- Proforma Invoice of the Car

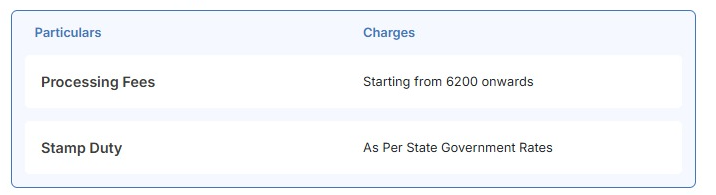

Fees and Charges

New Car Loan Reviews

I was initially concerned about hidden charges and high fees when applying for a new car loan, but Prime Loan Company was completely transparent from the very beginning. They offered me an affordable loan with no hidden costs or unnecessary add-ons. What they promised is exactly what I got, and I truly appreciated their honesty and clarity. The entire process was smooth and stress-free—I’m very happy with the outcome!

Seema Singh

Happy Client

I was dreading the paperwork and complex procedures involved in applying for a new car loan, but Prime Loan Company made the entire process incredibly smooth and convenient. They took care of all the heavy lifting, and I barely had to worry about a thing. Their team was professional and well-organized, and my loan got approved much faster than I expected. I highly recommend Prime Loan Company for anyone looking for a hassle-free new car loan experience!

Rajni Malhotra

Happy Client

FAQs on New Car Loans

What is a new car loan?

A new car loan is money you borrow to buy a brand-new car, which you repay in installments.

How do new car loans work?

You get money from a lender to buy a new car, and then you pay back the lender in smaller amounts over time.

What's a down payment?

A down payment is a part of the car’s price you pay upfront, and the rest is covered by the loan.

What's an interest rate?

The interest rate is the extra money you pay on top of the loan amount, like a borrowing fee.

How long is a new car loan?

New car loans can last a few years, usually 3 to 7 years.